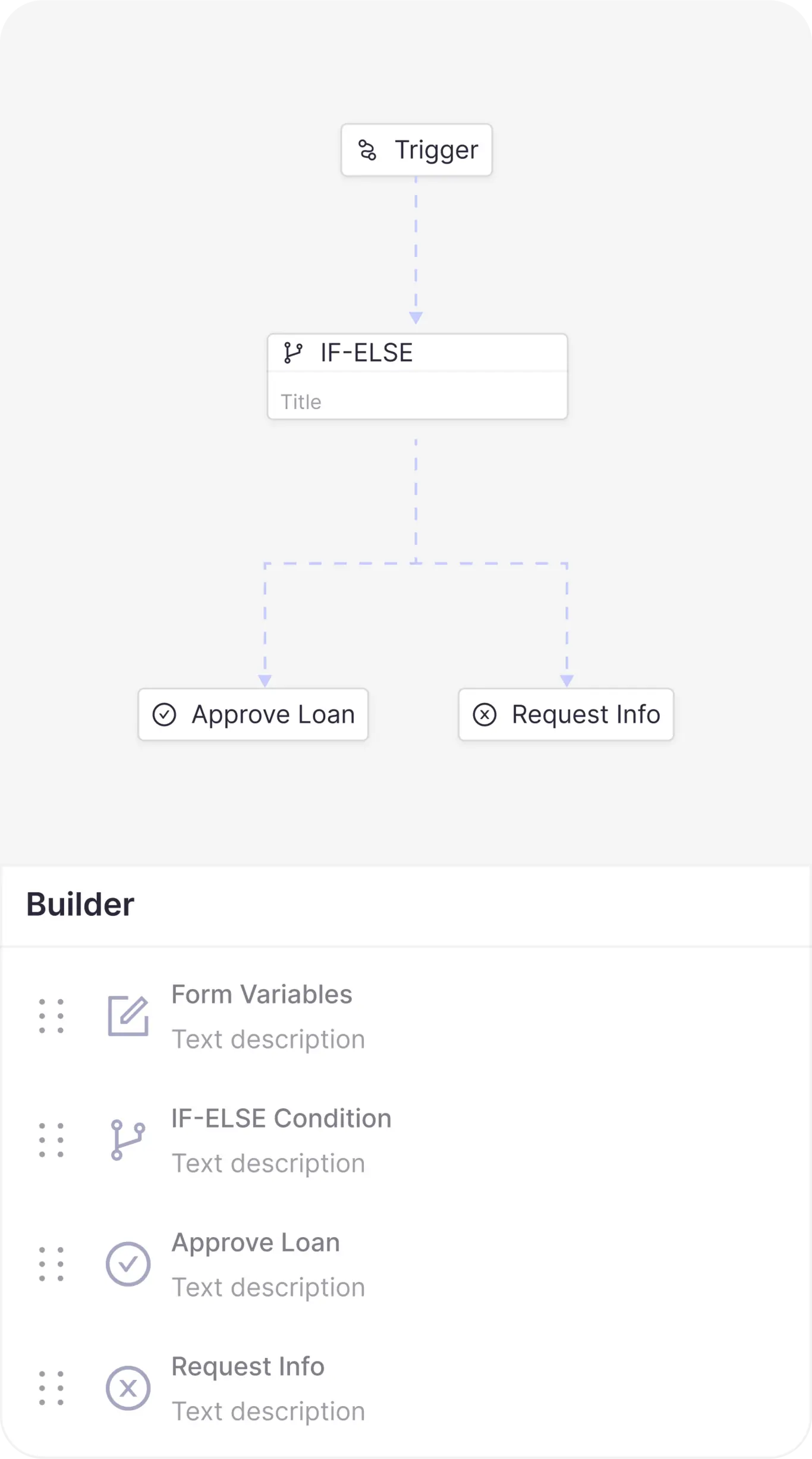

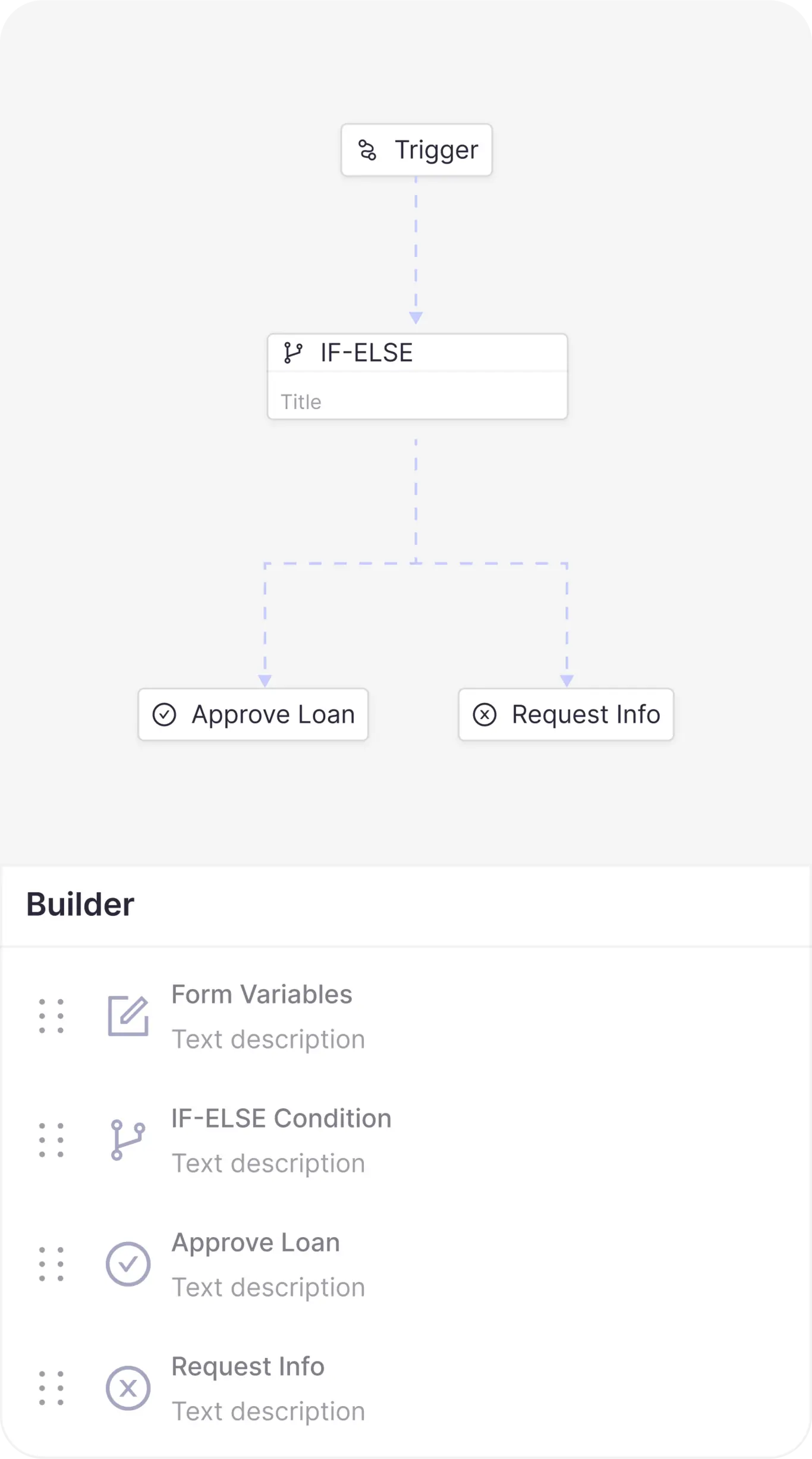

Decision model

Decision engine for loan applications : Automate the evaluation of loan applicants using fully configurable decision trees.

Introducing Rubyx solutions

Scroll to see more

Decision engine for loan applications : Automate the evaluation of loan applicants using fully configurable decision trees.

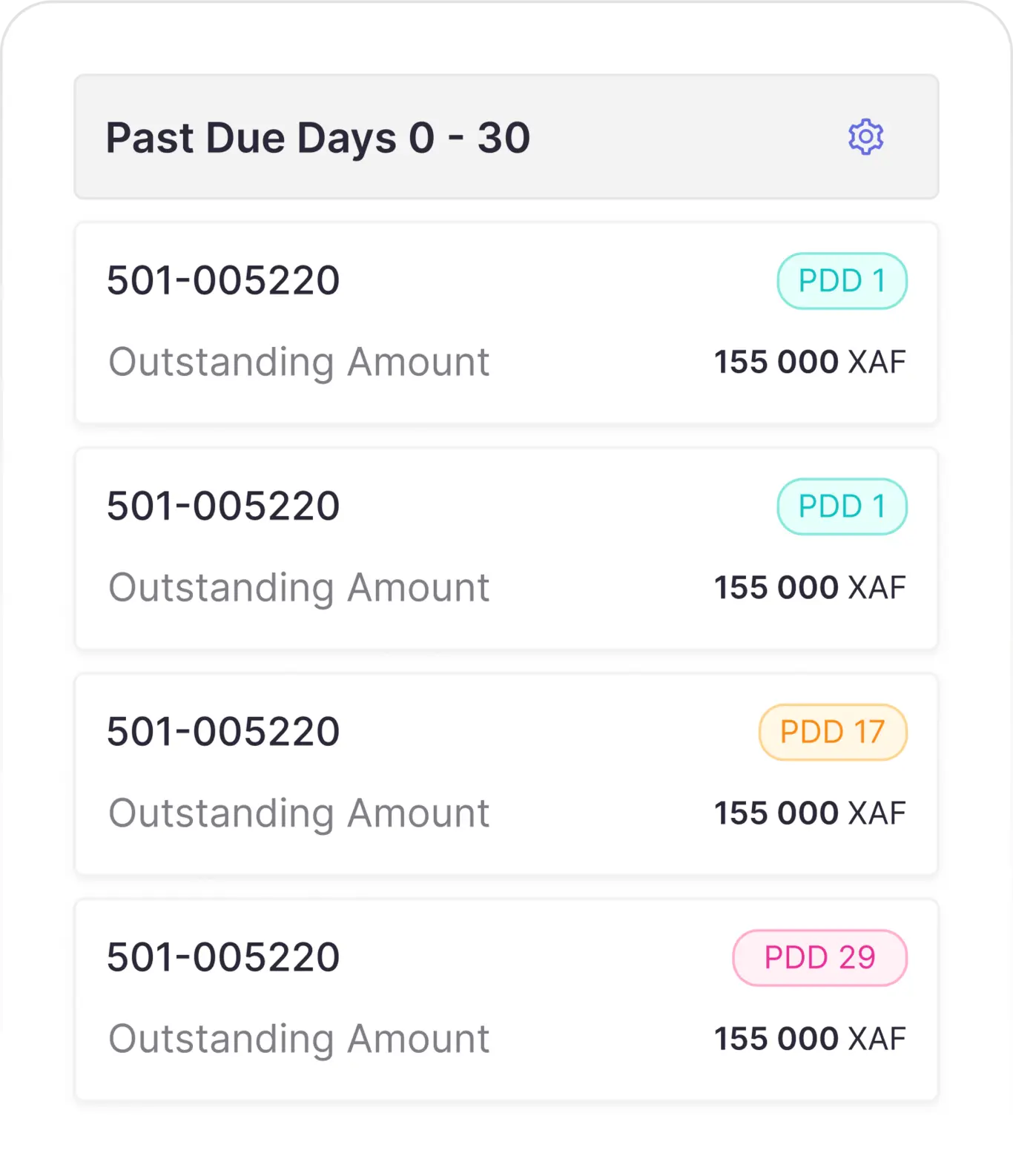

Focus your recovery actions where it matters using probability of recovery for customers in arrears.

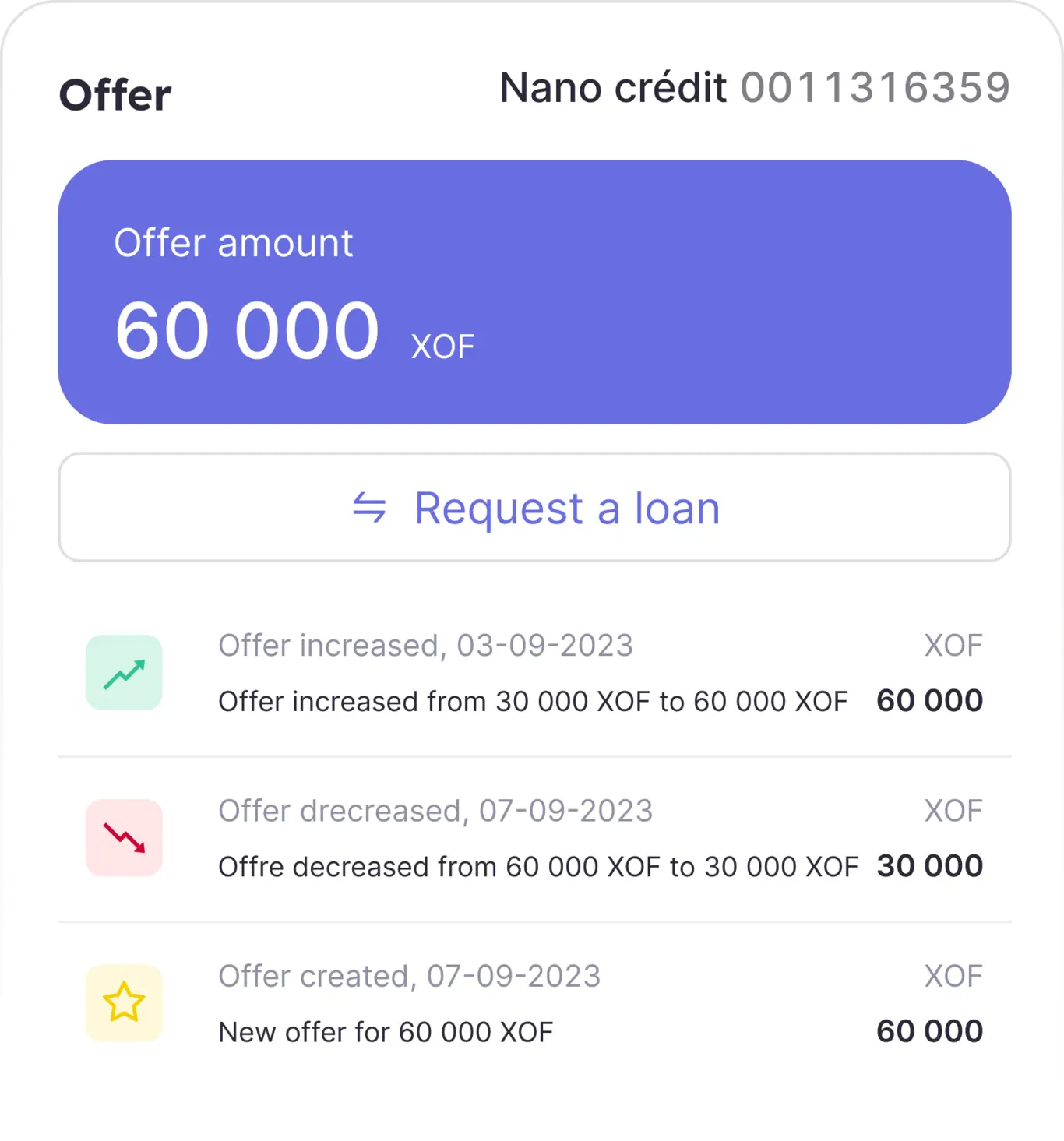

Generate tailored nano loan offers for borrowers and non borrowers.

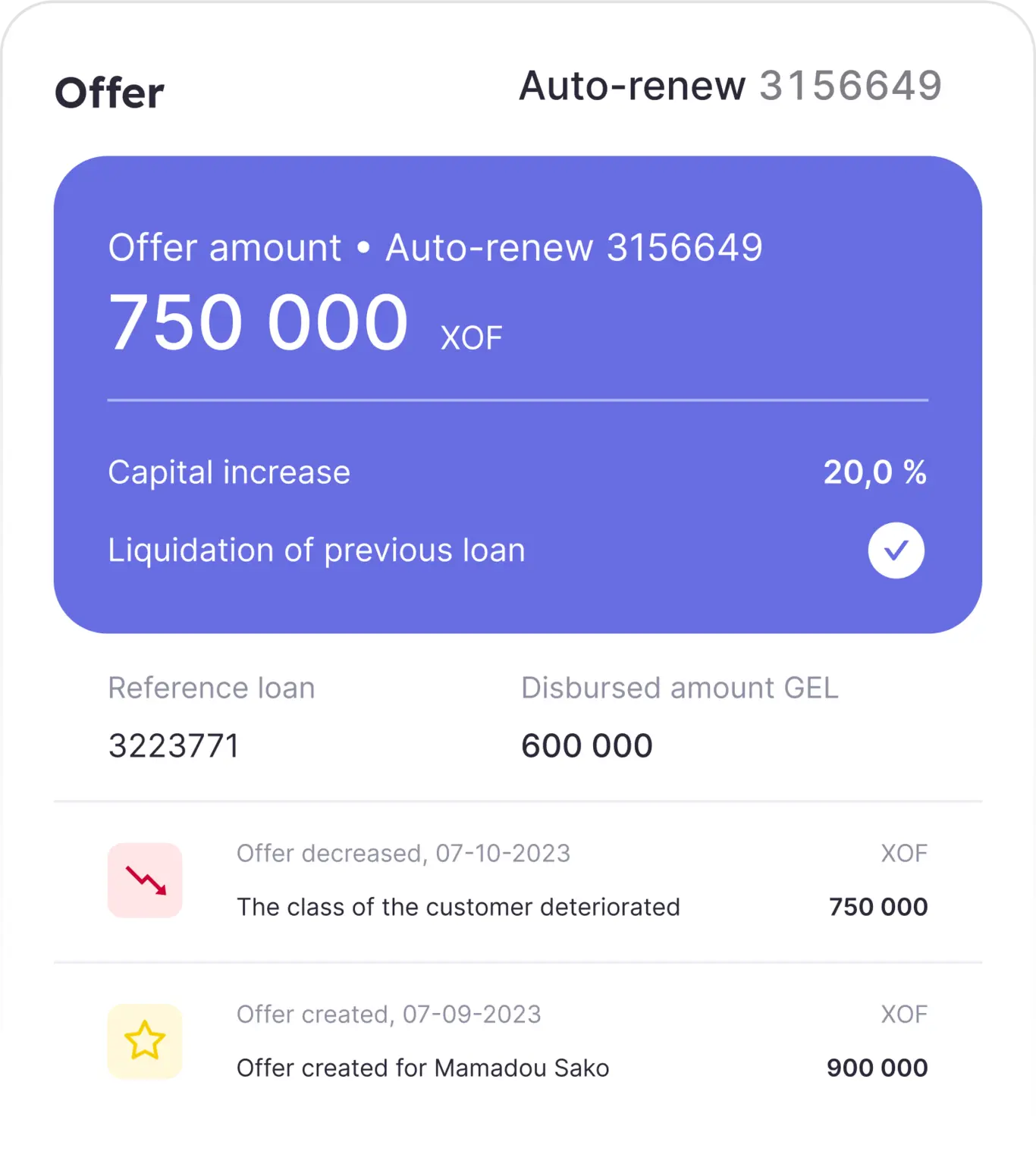

Push tailored loan renewal offers to the best customers in your portfolio..

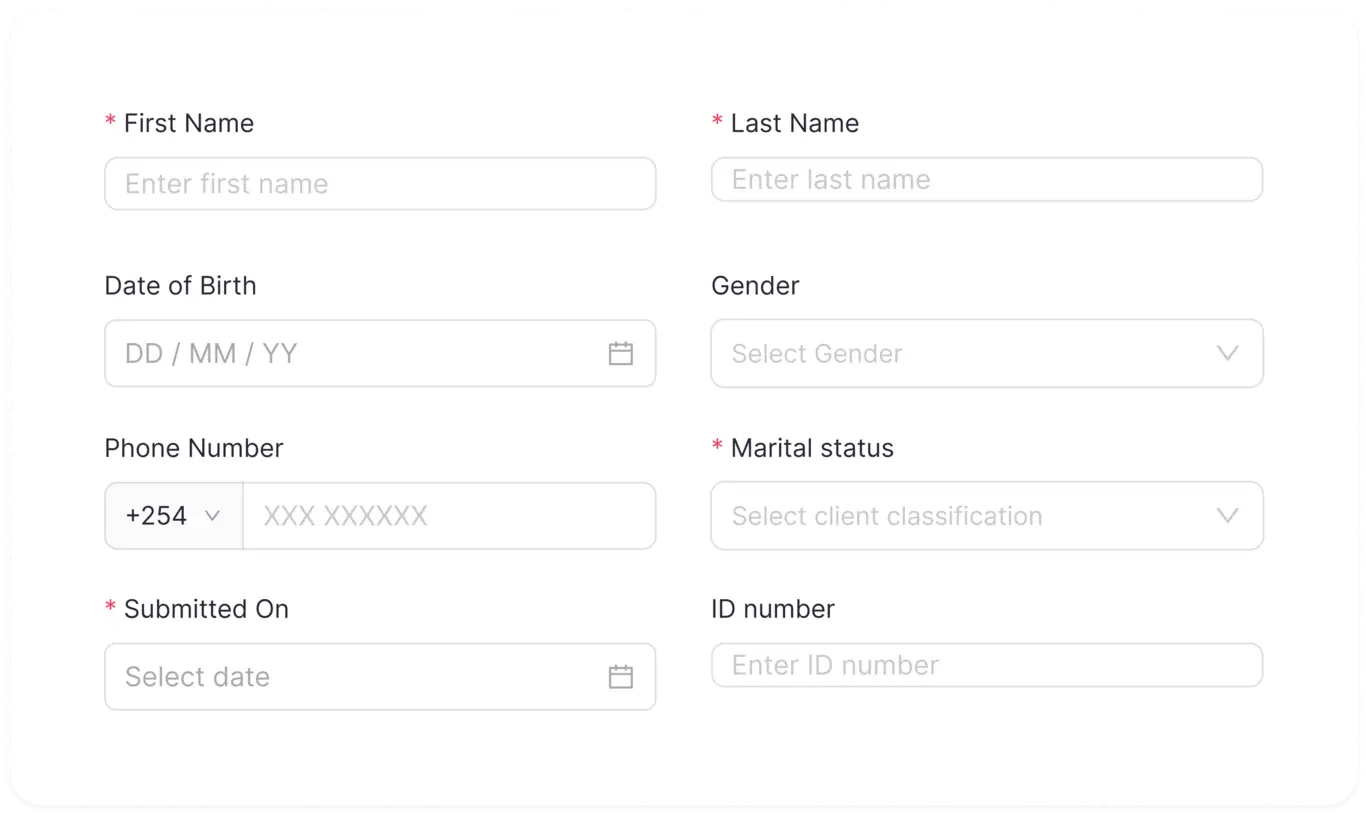

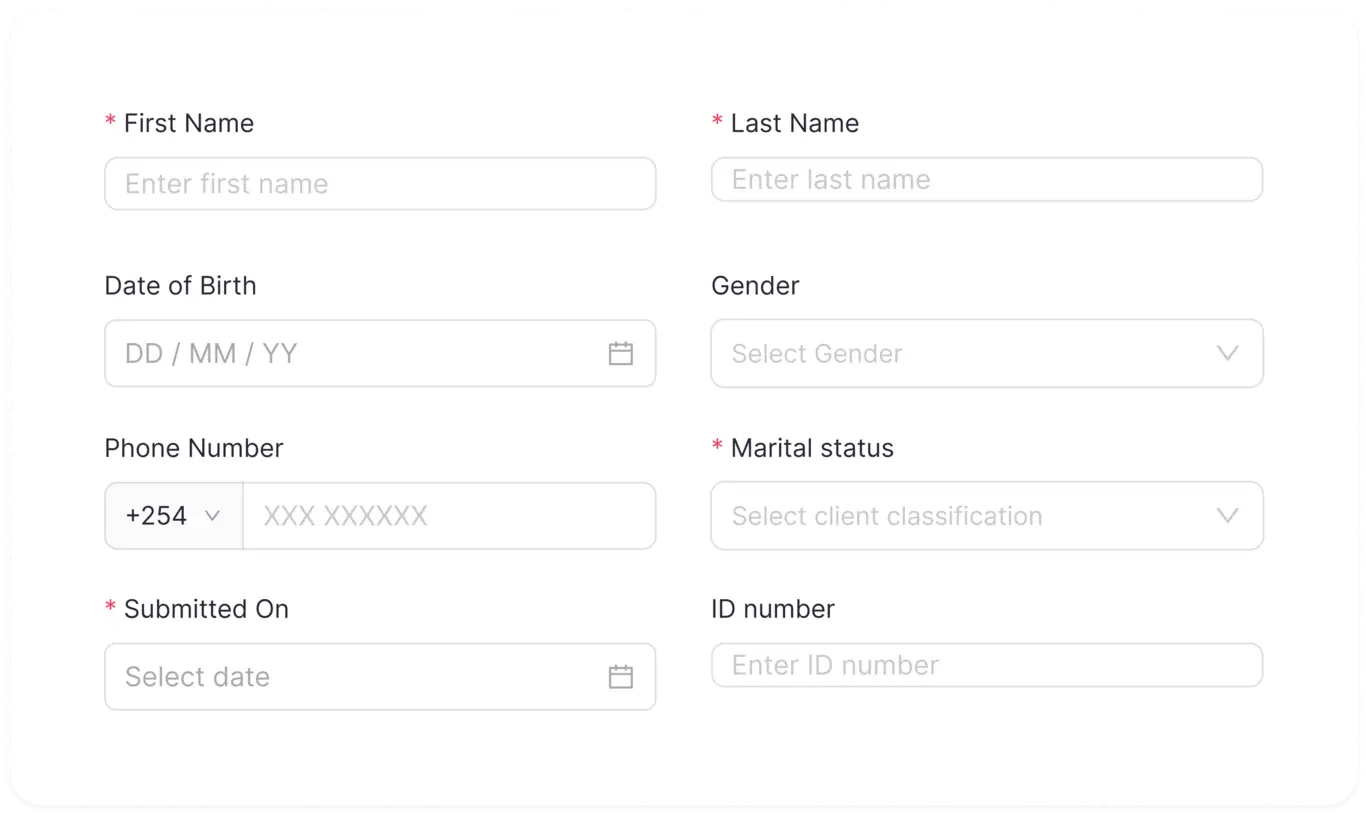

Create new customers

Manage the entire client journey, providing your frontline with a supporting tool to optimize the commercial relationship and maximize customer lifetime value.

All you need to know in one place

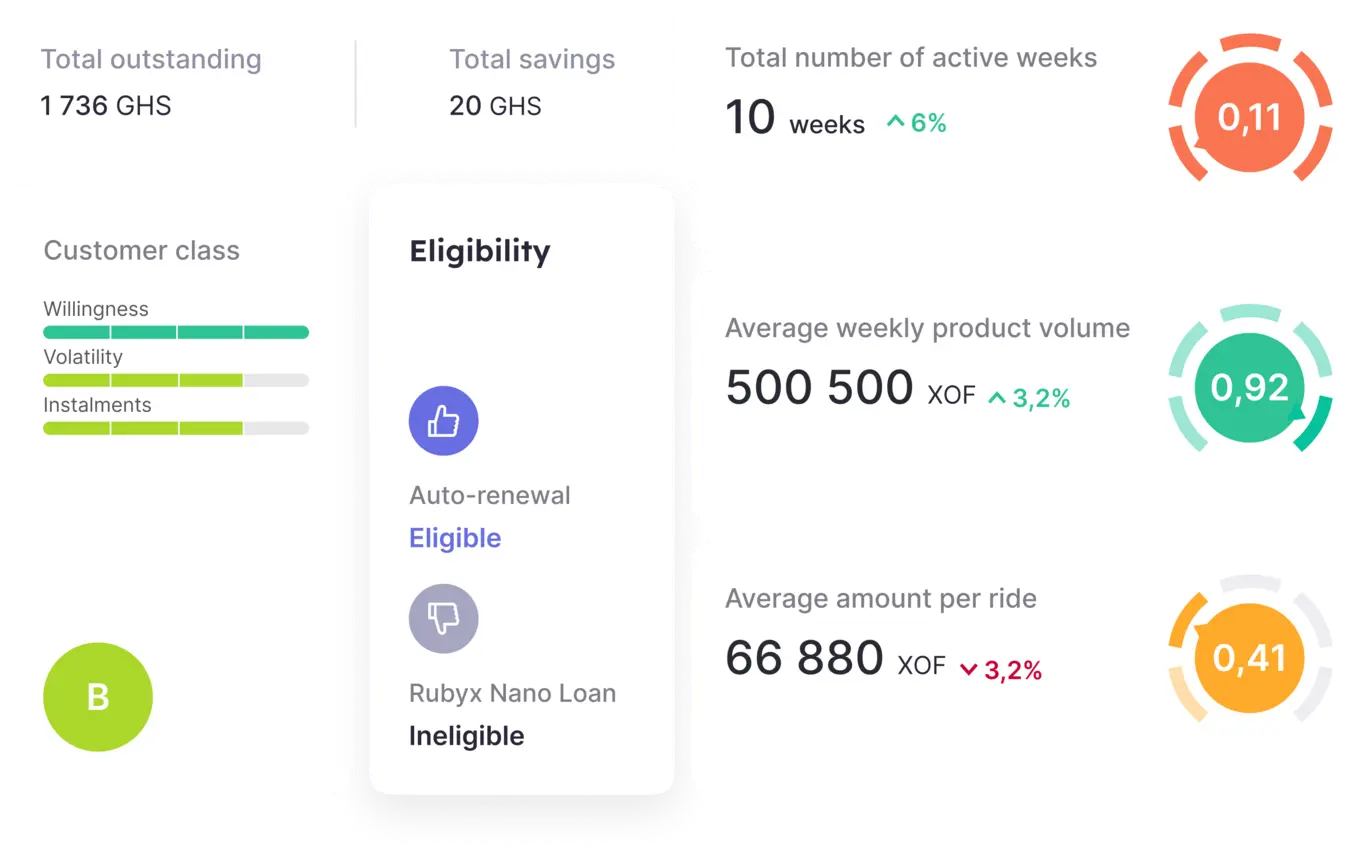

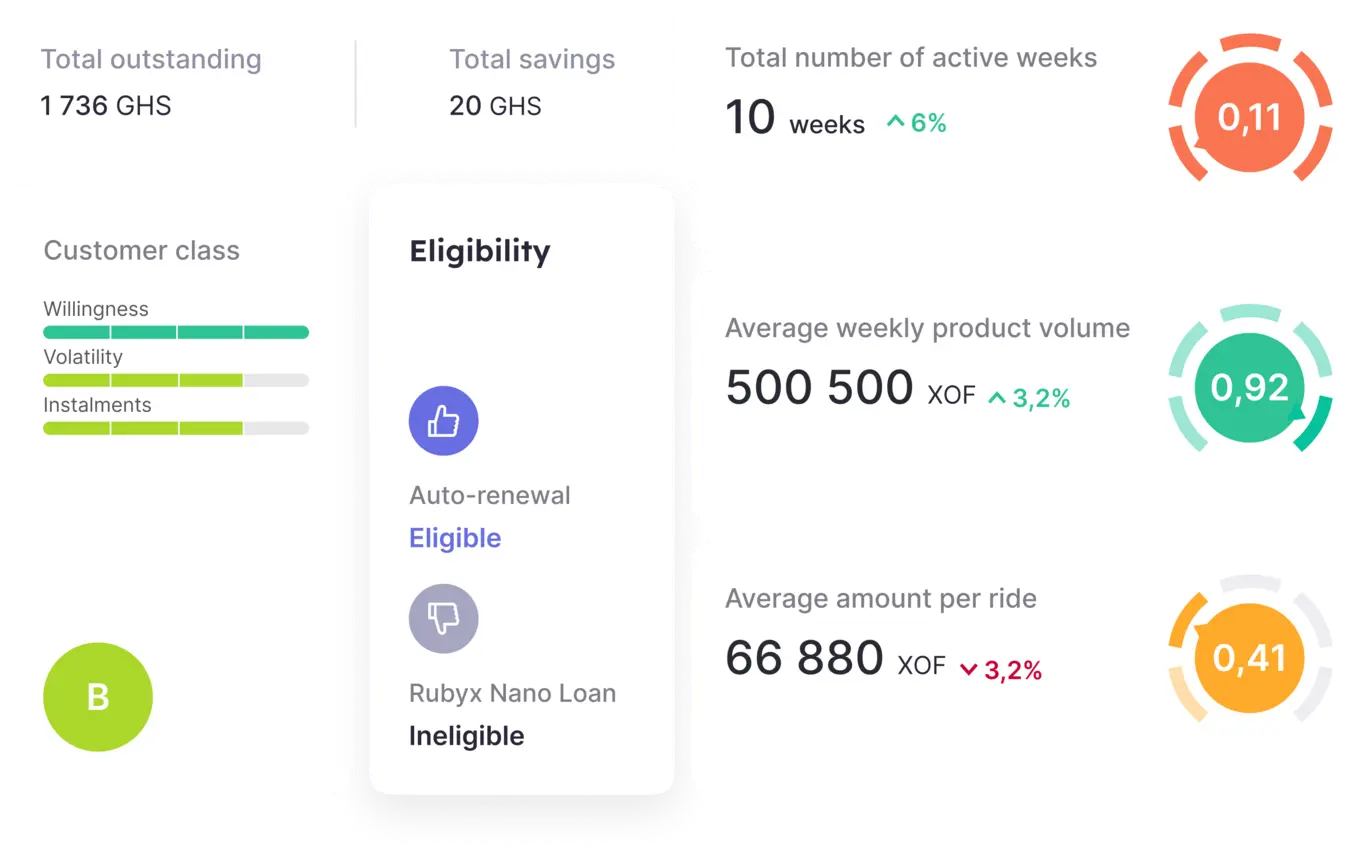

Get a unified 360° view of customer information, encompassing all interactions, financial behavior, risk profile communication history and product holdings.

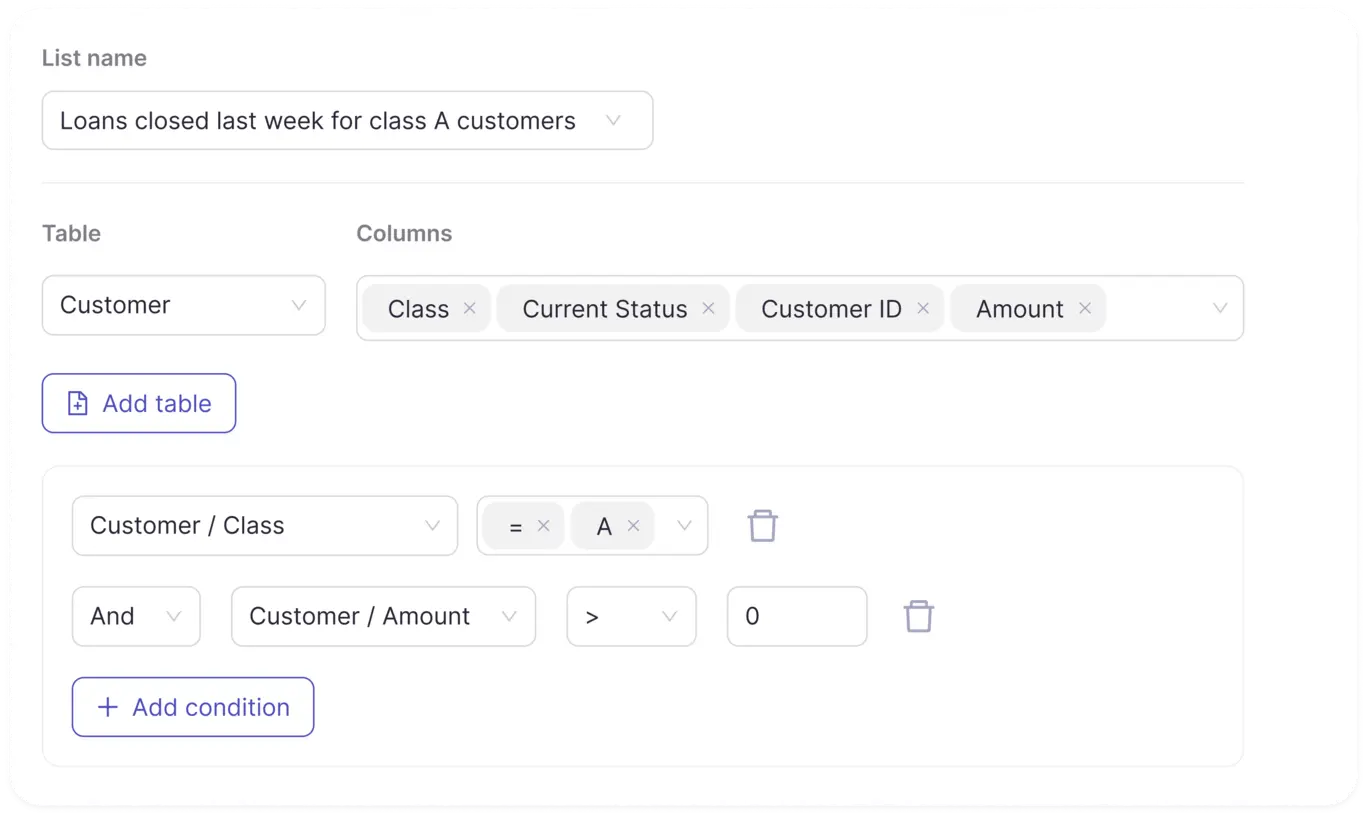

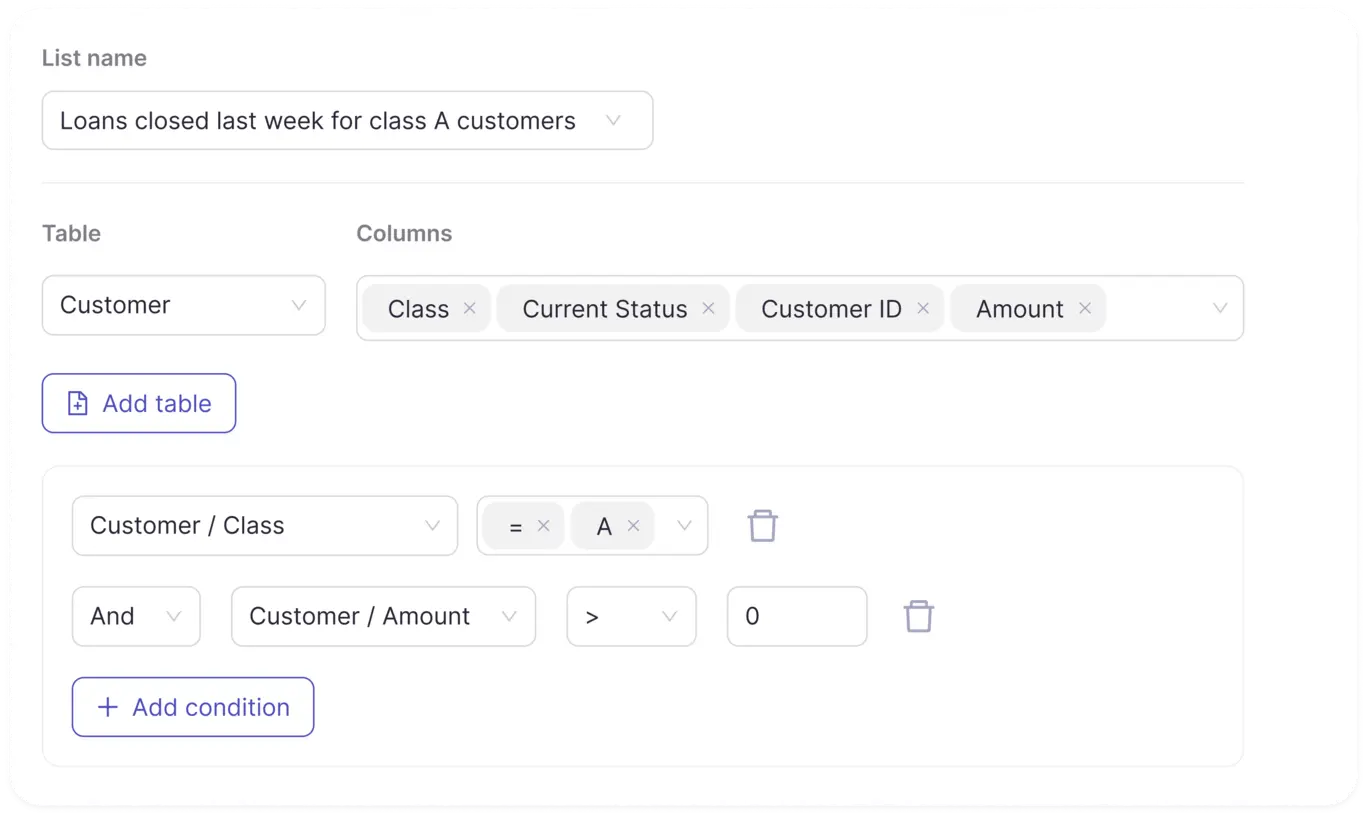

Leverage data warehouse for tailored segmentation and listing

Categorize customers based on their behavior into meaningful groups that provide insights from both a business and risk perspective.

Visualize and easily understanding behaviors

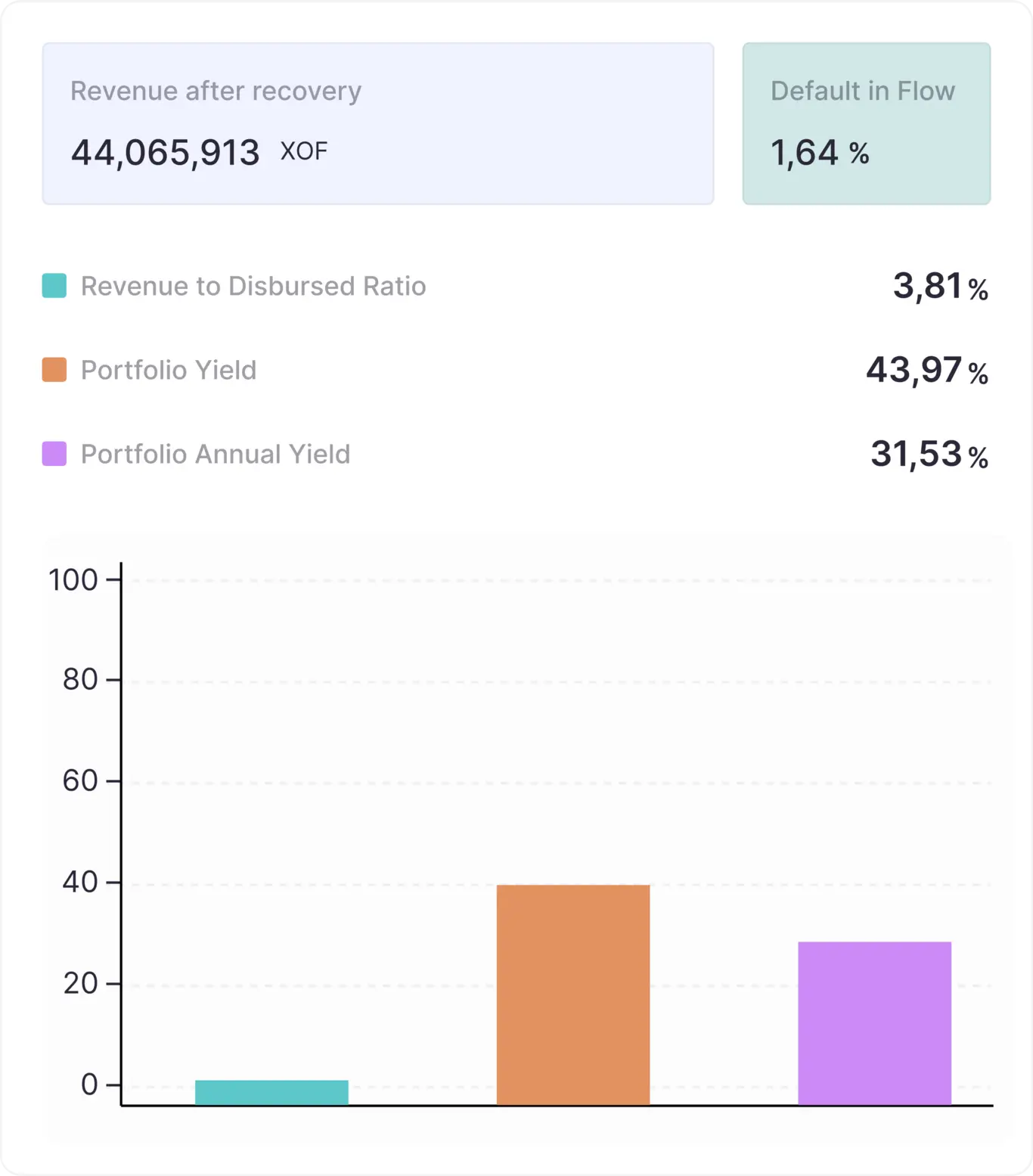

Quickly understand customer behavior using tailored business metrics and visualizations.

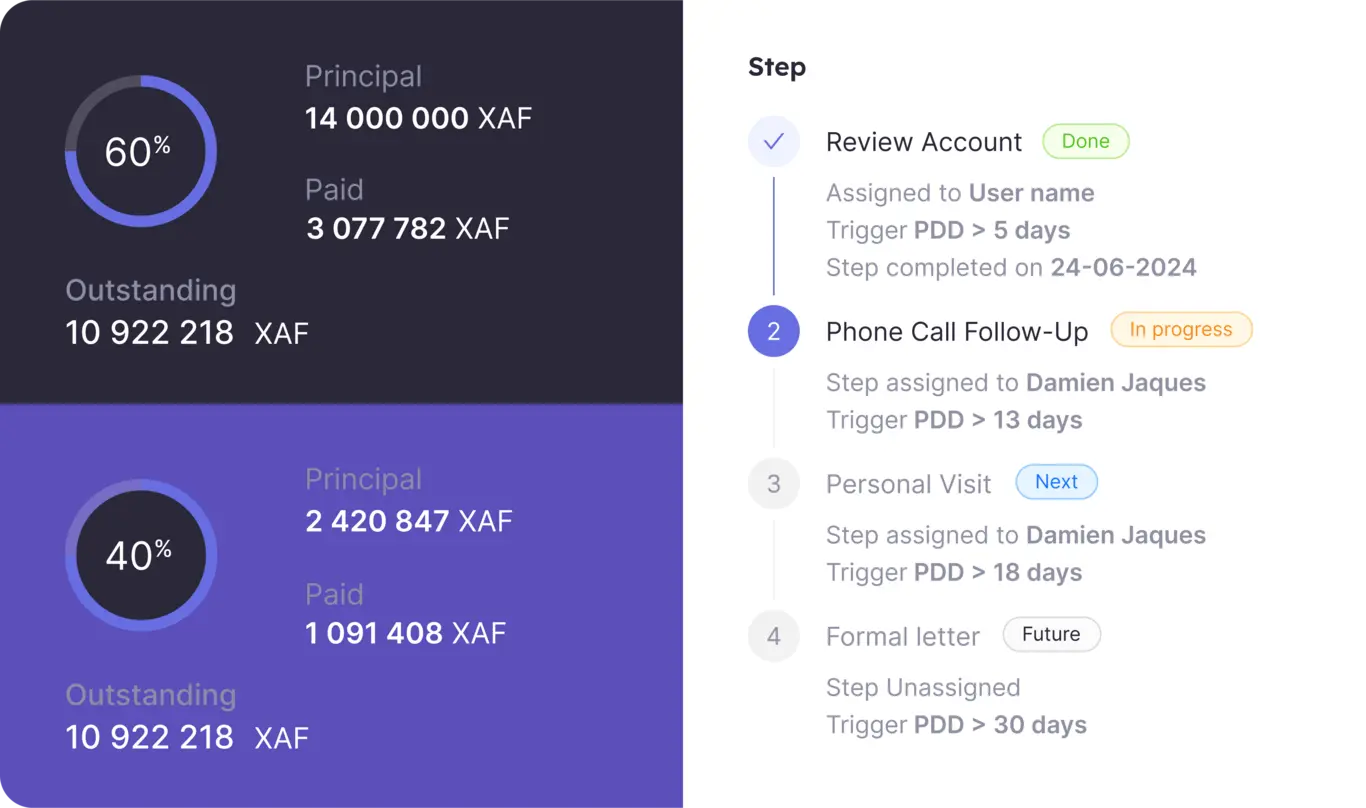

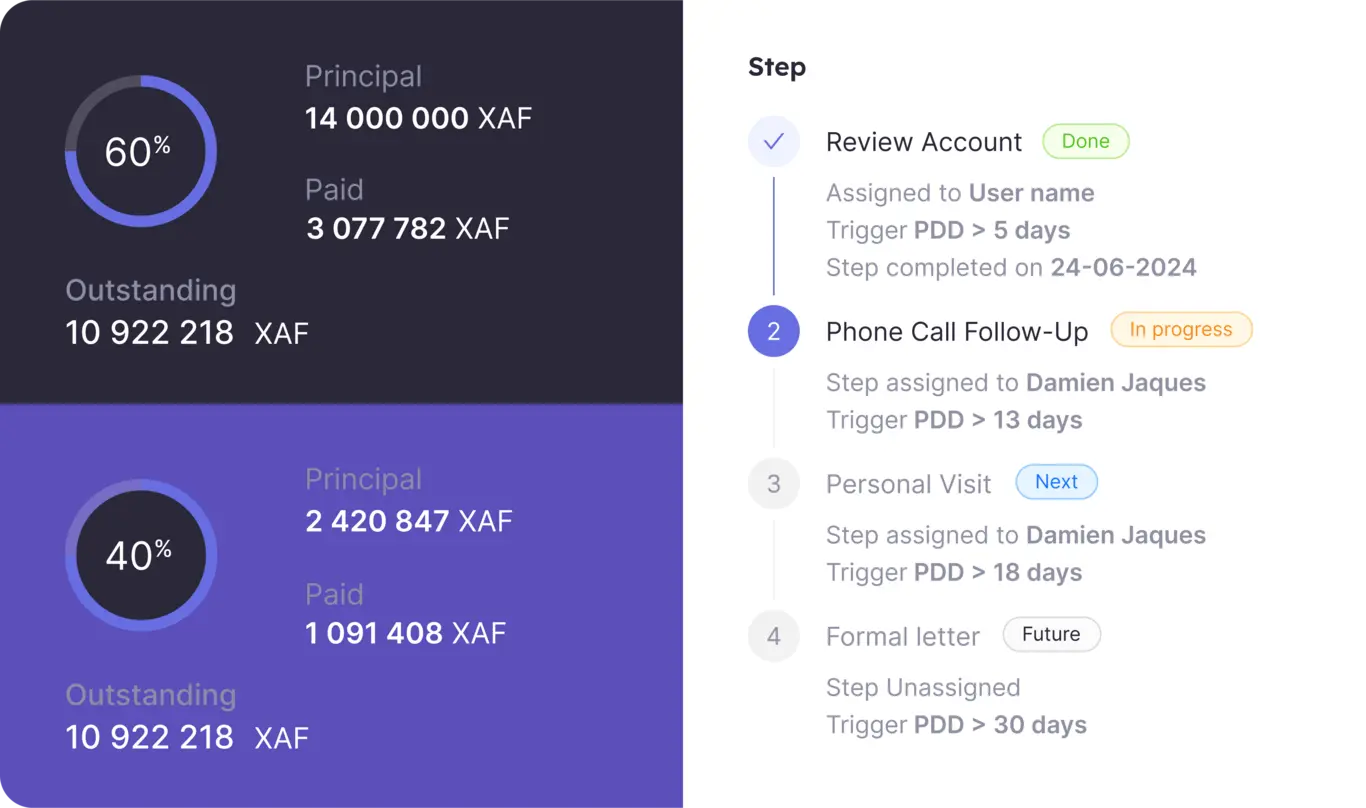

Strengthen your collection effort

Manage and optimize debt recovery processes through tailored performance metrics, customizable strategies and early warning systems ensuring effective and efficient collection outcomes.

Create new customers

All you need to know in one place

Leverage data warehouse for tailored segmentation and listing

Visualize and easily understanding behaviors

Strengthen your collection effort

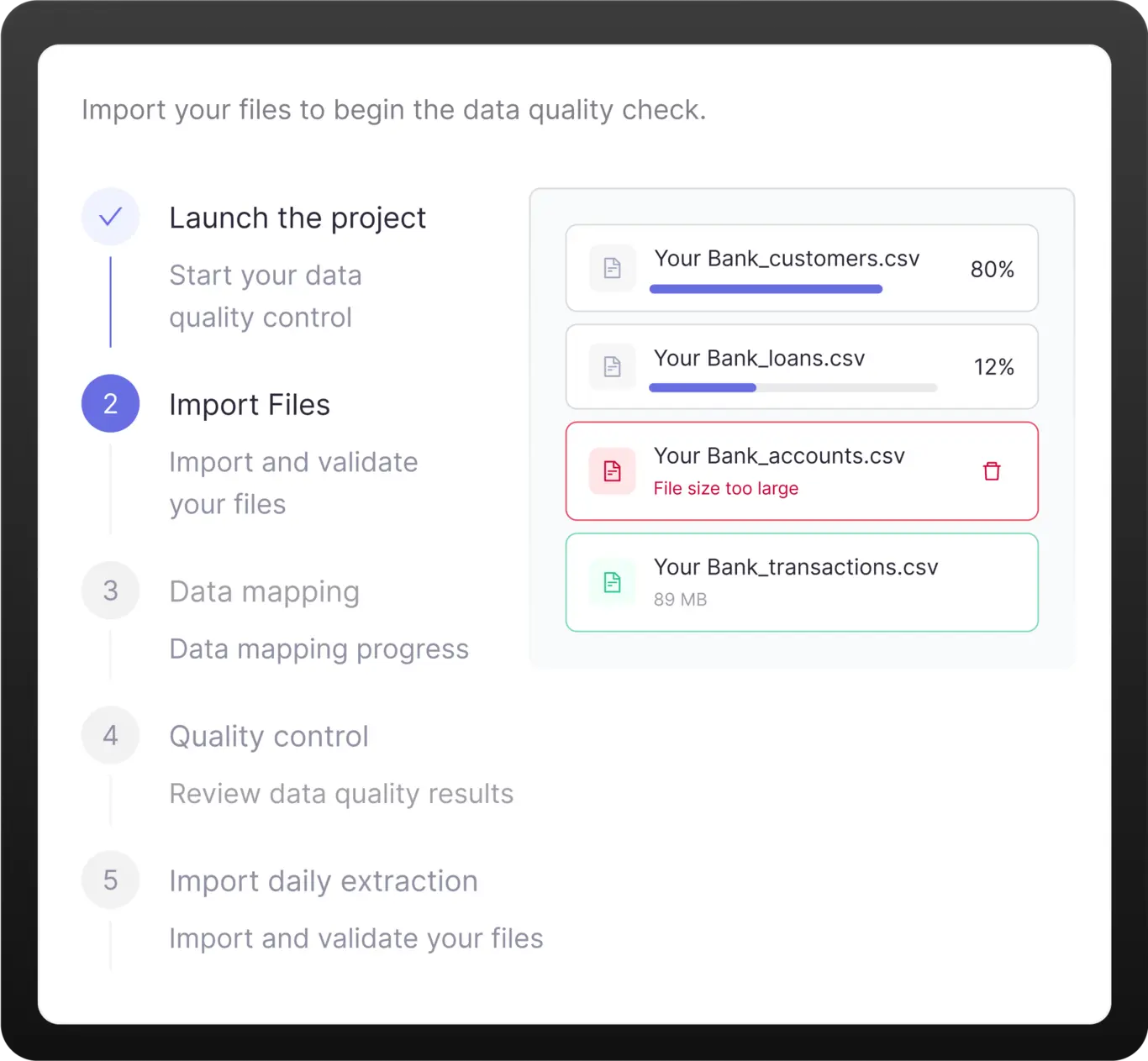

Share your existing data structure or use our proprietary data model to feed our cloud-based data warehouse and benefit from our advanced data quality controls to identify any issue in your data, ensuring continuous reliability.

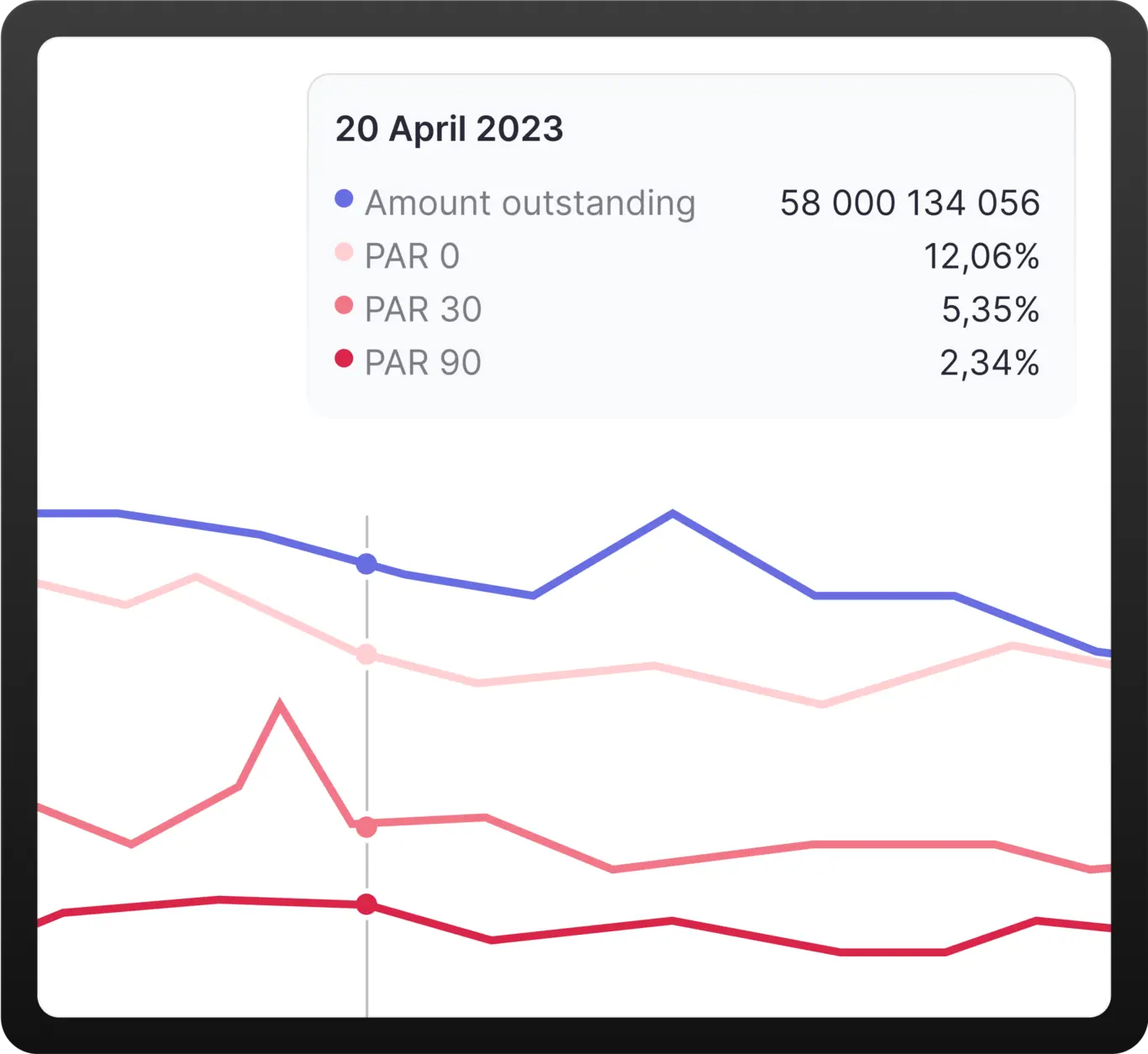

Monitor the daily evolution of your portfolio, including dedicated tools for risk monitoring such as vintage analysis and roll rates visualizations.

Customize your own reports for financial and operational performance and provide direct access to your team with detailed data scope management.

Build automated workflows customized to your business and integrate our platform with any third-party application using our API portal and webhook module.

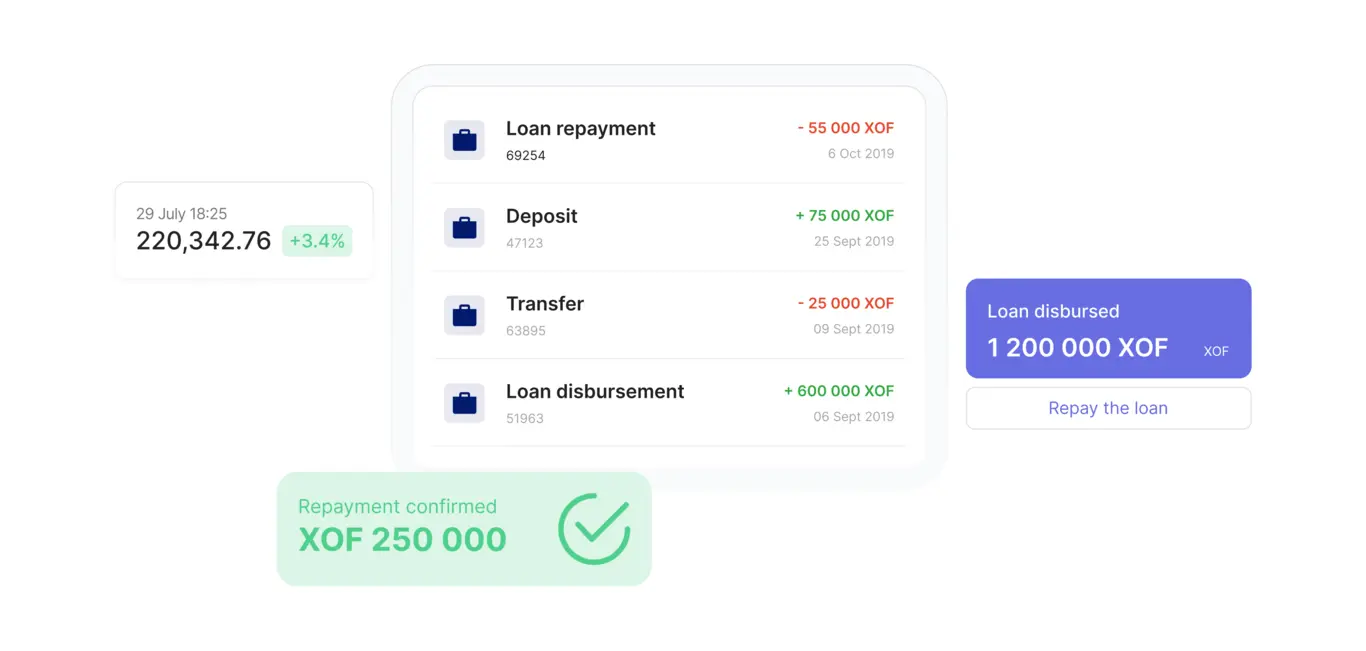

Simplify loan bookkeeping with our Core Banking Solution – Seamlessly integrated with all essential technical components for a streamlined experience.

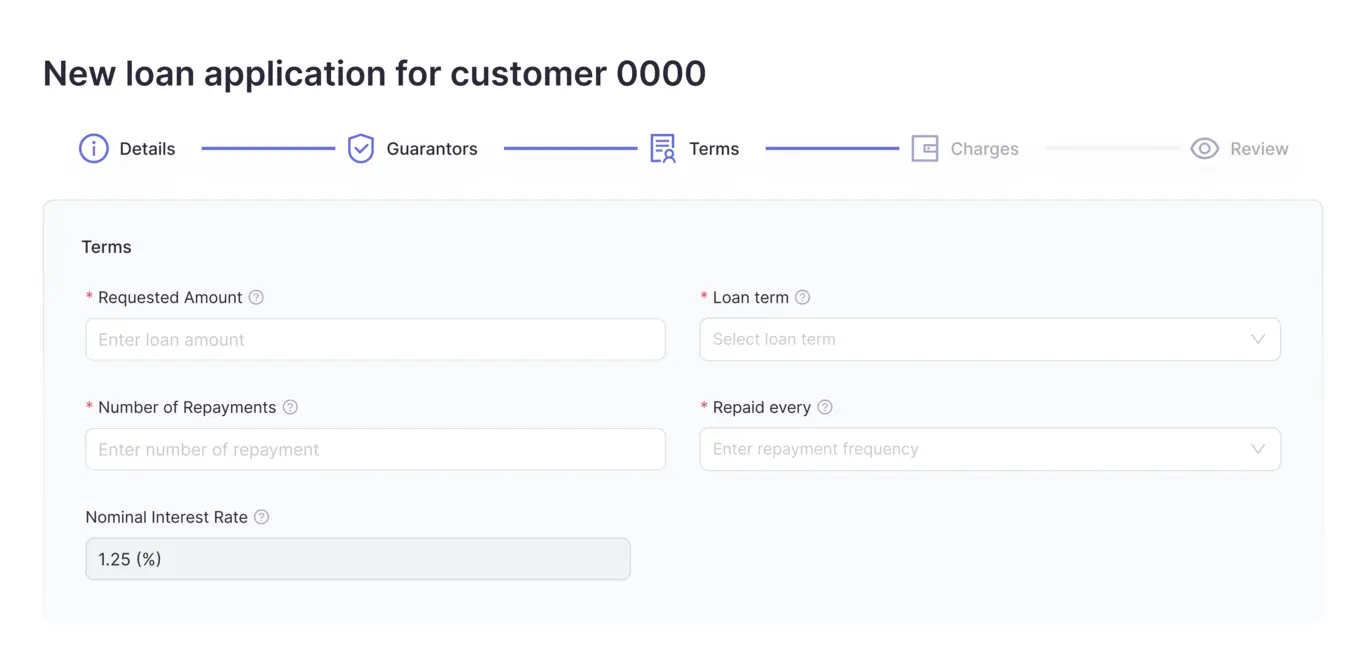

Create a new loan application in the Core Banking System using our web interface.

Data analytics and credit scoring optimization.

Digital lending strategy

Risk management advisory

Loan product and customer experience design